Real Estate Headwinds and Tailwinds;

Is the Answer Blowing in the Wind?

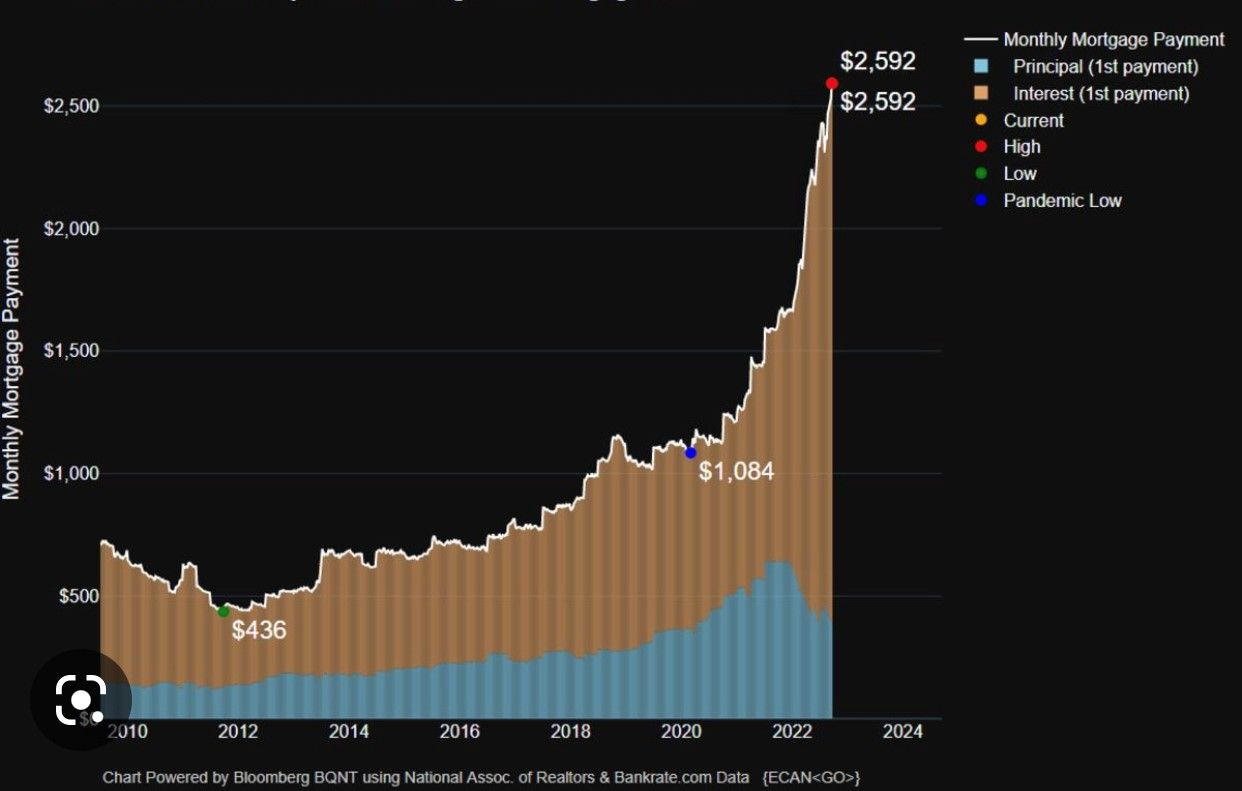

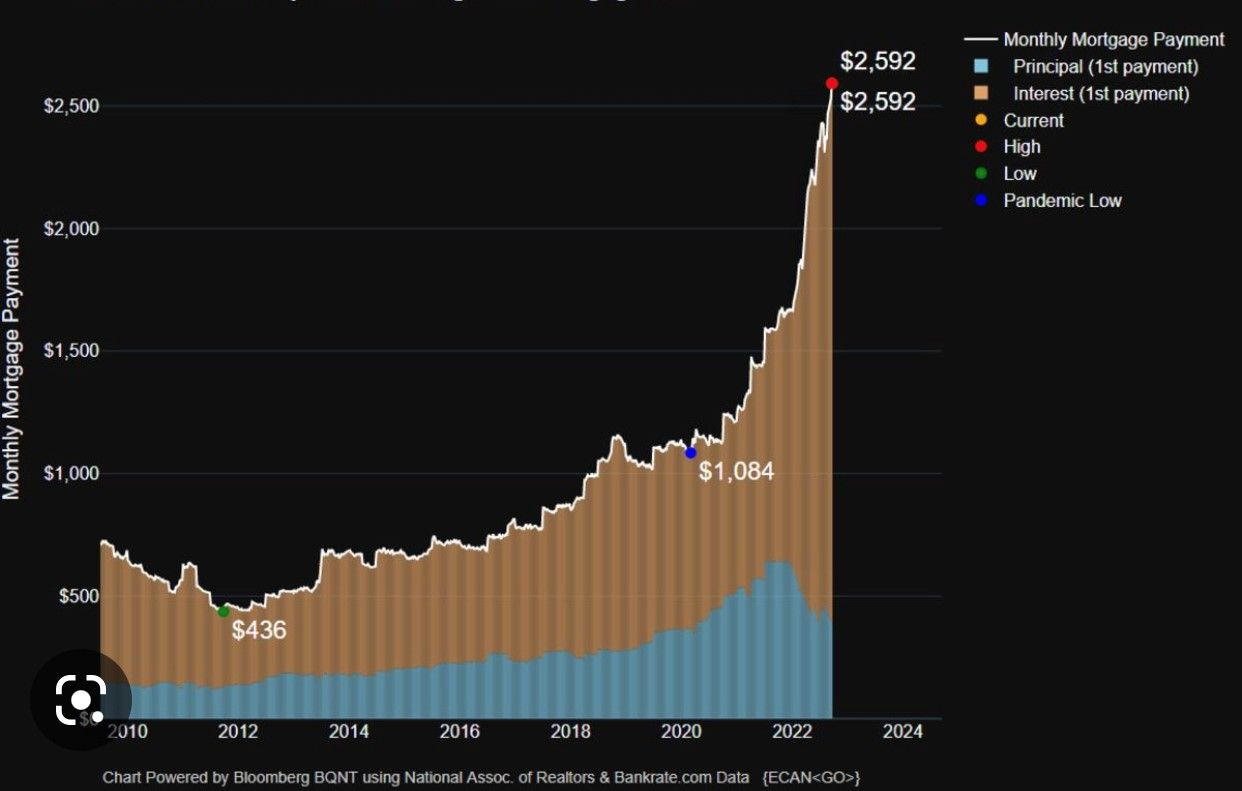

Monthly Mortgage Payment, Median Home Prices

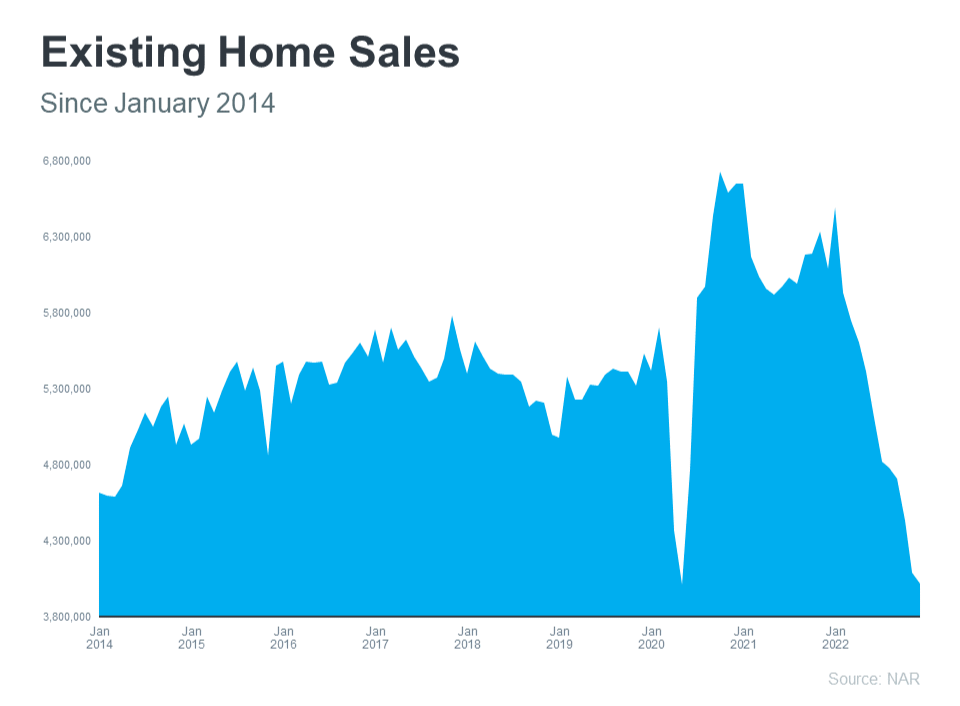

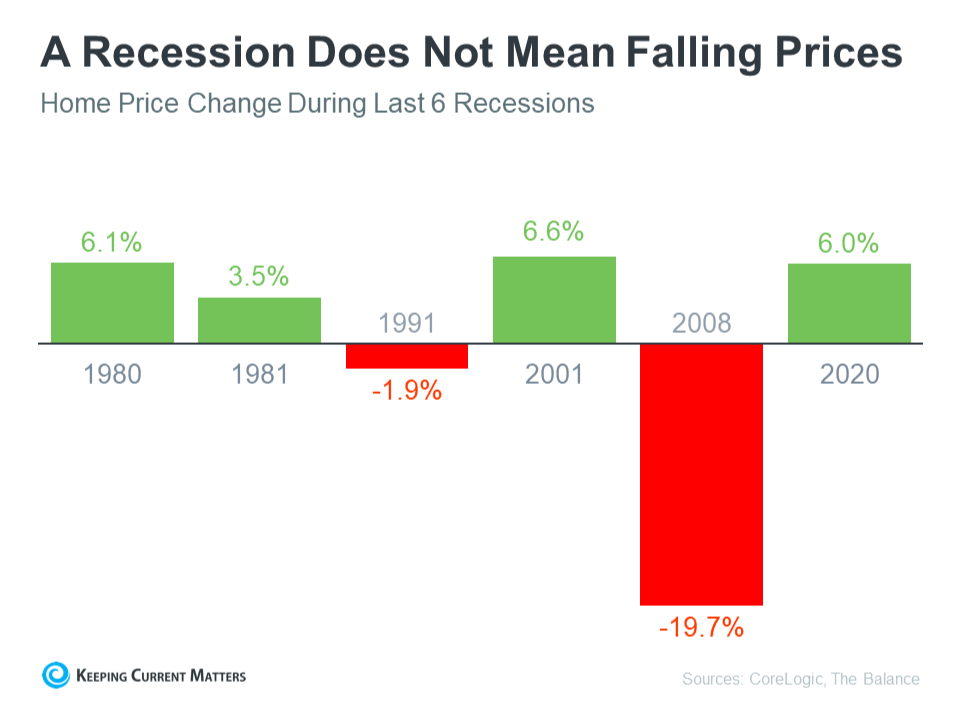

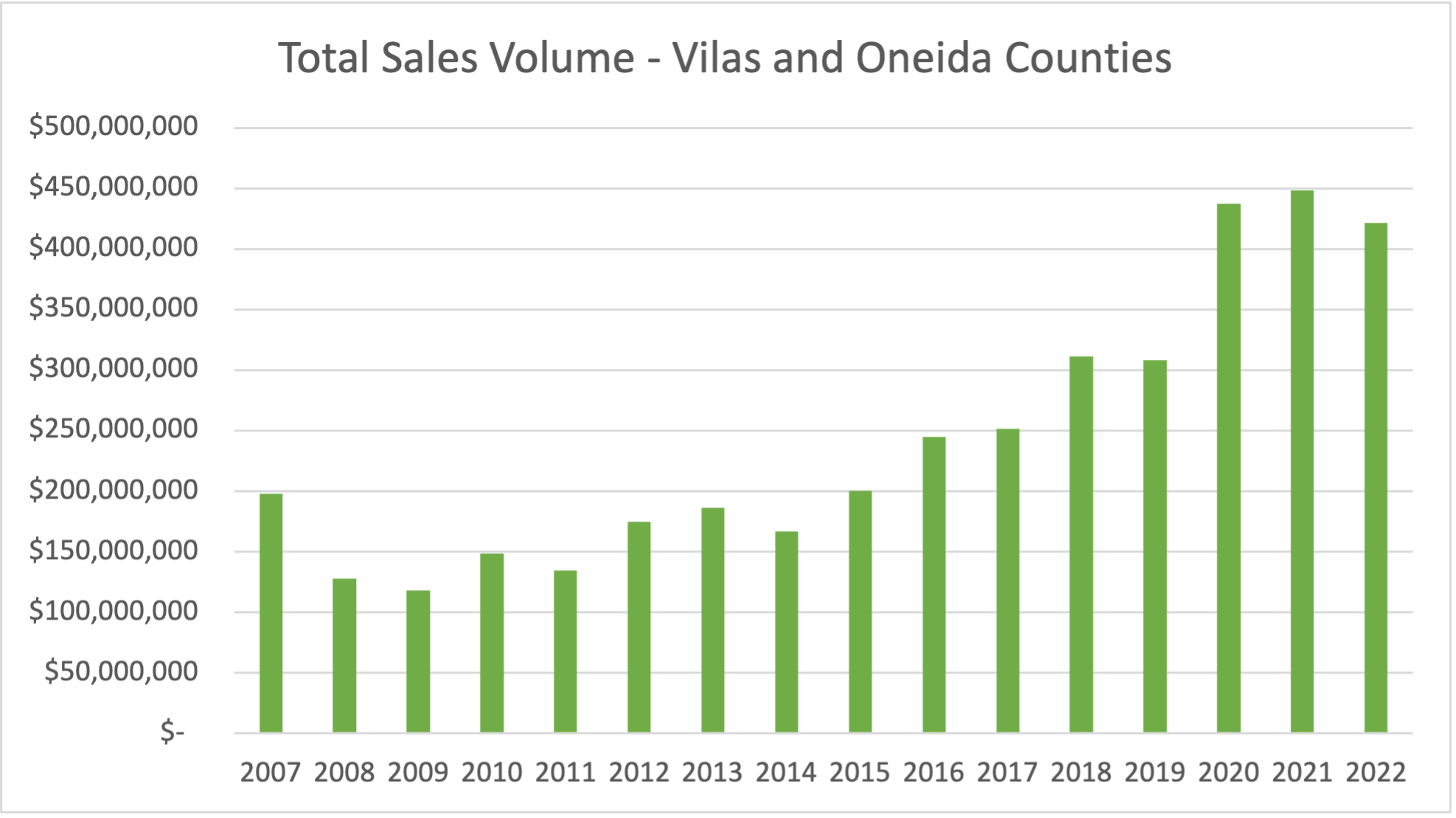

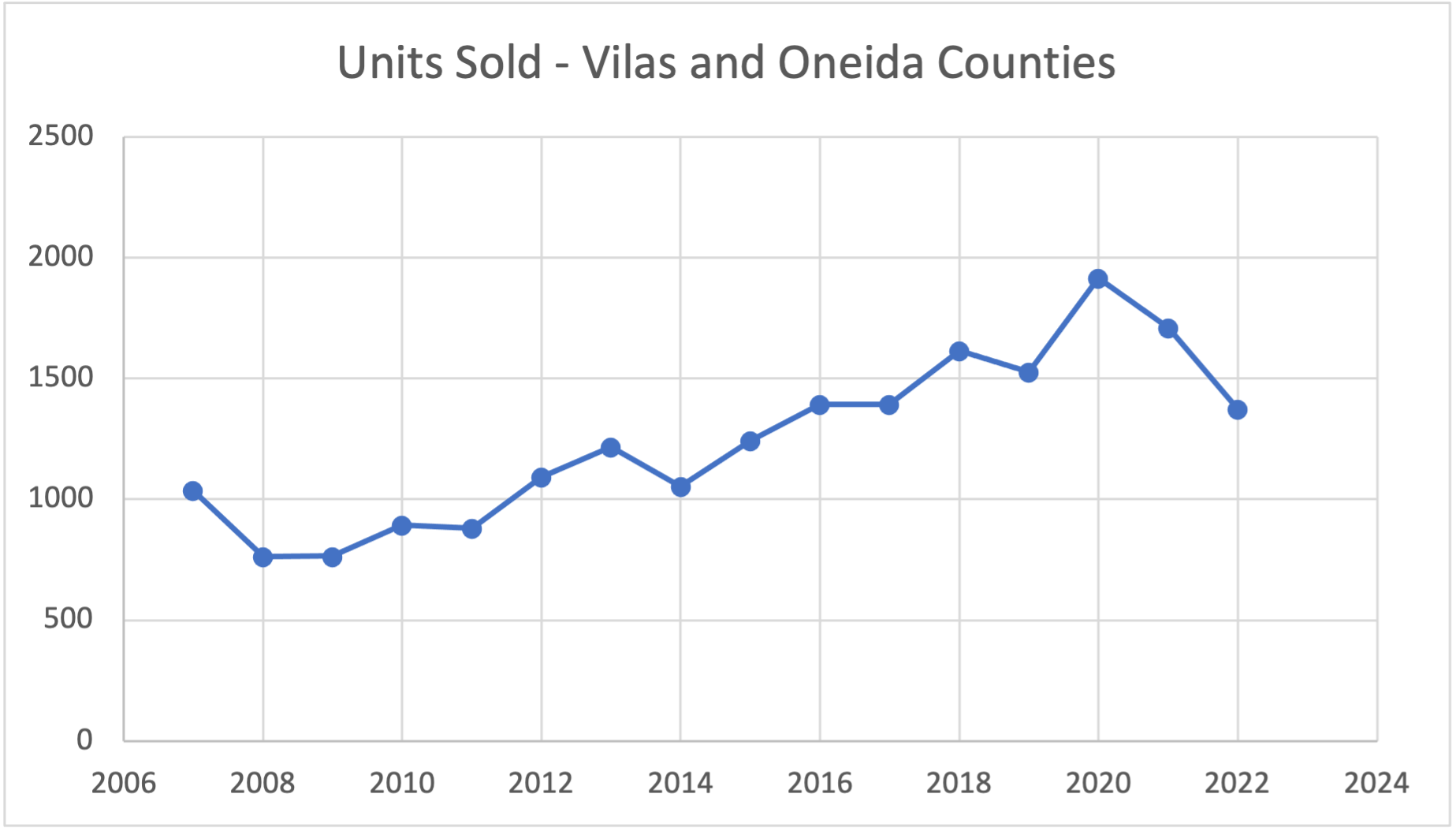

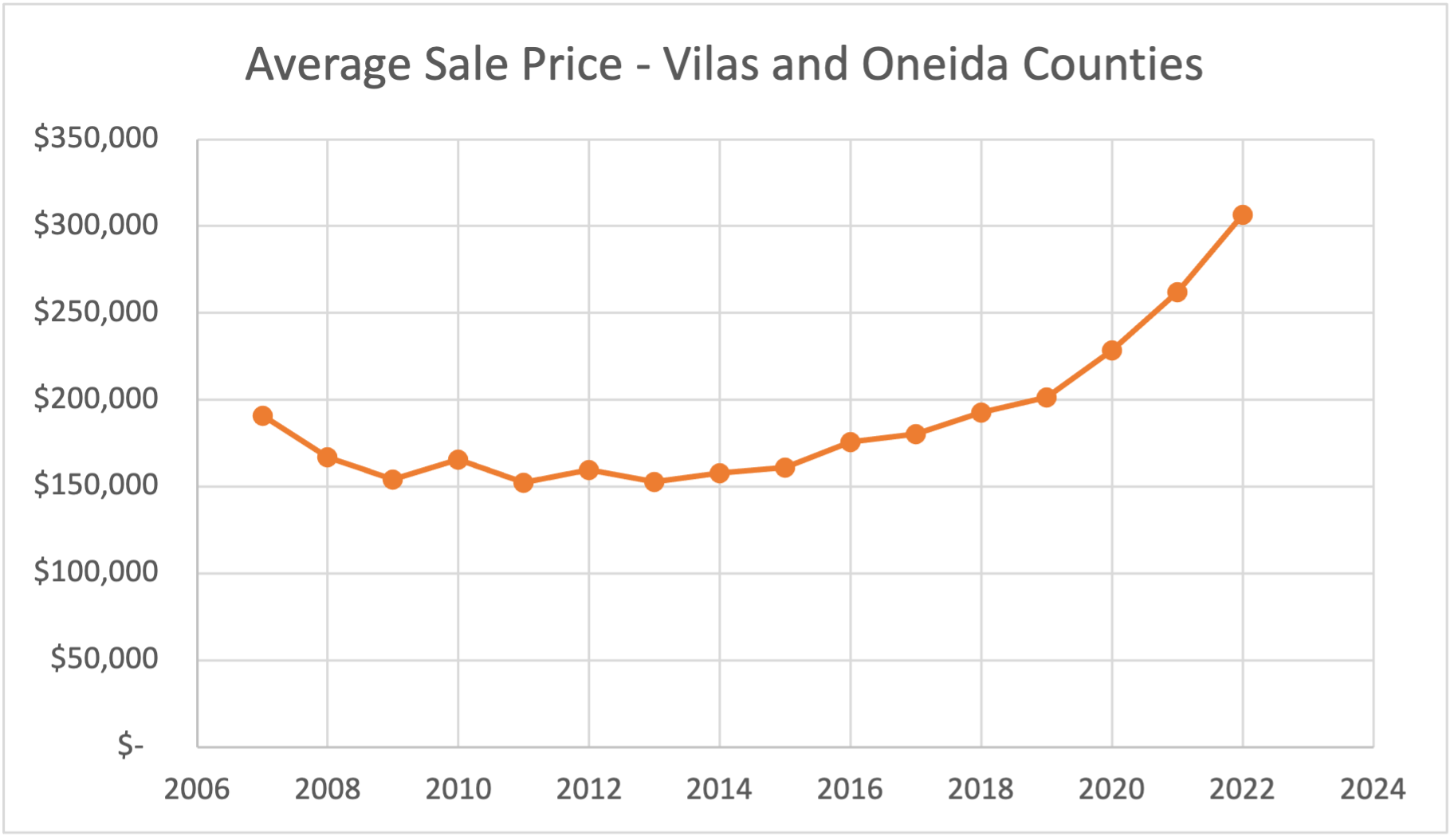

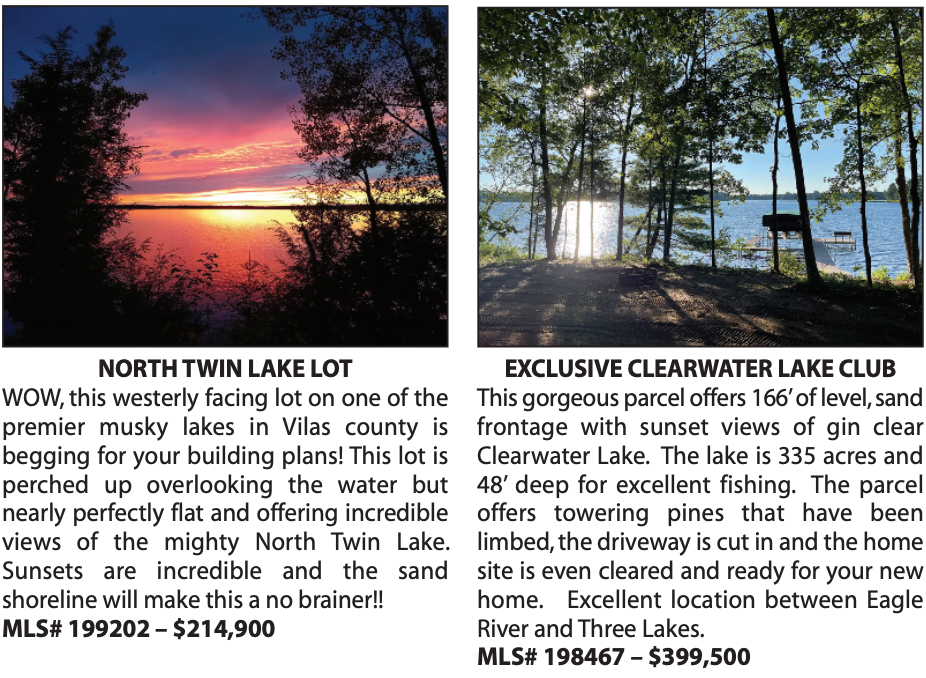

The real estate market is facing real headwinds. We haven’t seen interest rates this high since the early 2000’s. Nationally, there are also some economic signals pointing to a possible mild recession. In fact, some metrics would say we are already in it. The latest reading has real estate demand down 25% from its pandemic peak. This, if you can believe it, is an improvement from November 2022—when it was down a staggering 40%. Sales volume is also on the decline nationally and in the Northwoods specifically. Consumer debt hit a fresh record at the end of 2022, while delinquency rates rose for several types of loans. The savings rate, although still strong, has been declining as well. These signals suggest buyer demand will continue to slow. The latest US existing home sales report showed a record 12th consecutive month over month decline in January and it offered the weakest month over month change since October 2010. You will see why that is important before we are done. Also, in the last three years, home prices have risen in the Northwoods around 60%. Some say a move that significant invites an opportunity for a correction.

Important context: The average home/condo sale in Vilas and Oneida counties was $407,721 in 2022, with properties selling for 99.3% of list price after just 67 days on the market. For comparison, those numbers were $254,565, 95.2%, and 140 days on the market in 2019. So, in three years, the average home sale price in our market not only increased by 60%, but properties were selling in less than half the time. In addition, if you look at the last four months, the average home/condo sale in Vilas and Oneida counties sold for 96% of list after 73 days on the market, showing some weakening. Yet the average home sale is still around all-time highs at $406,015 during these last four months.

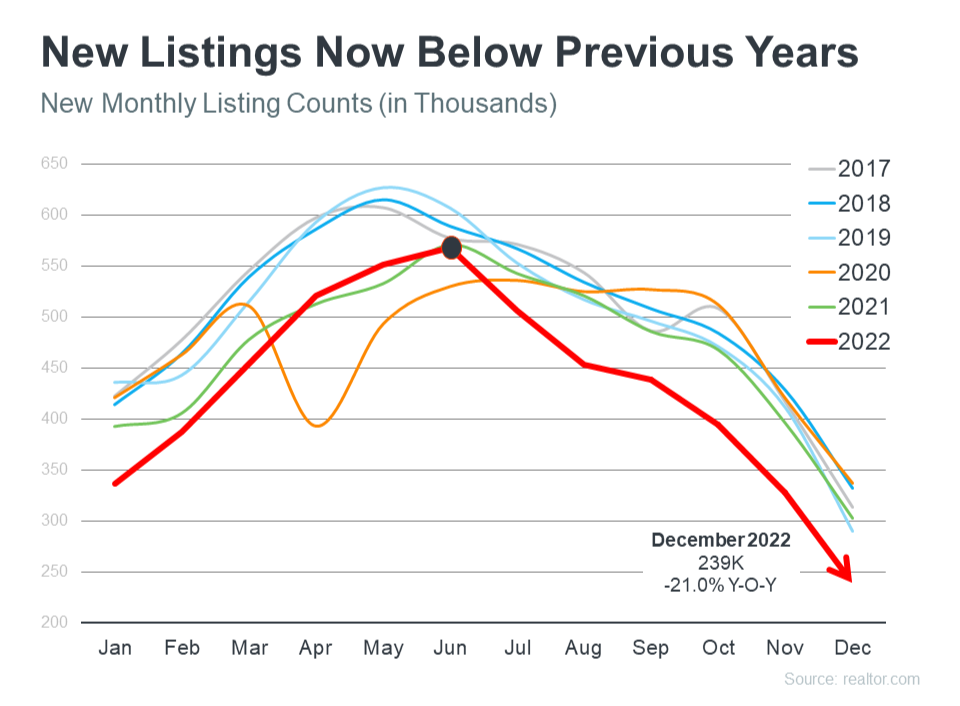

Why would Northwoods home prices remain at these levels with the headwinds in the real estate market? The answer is supply. Right now, the inventory of homes on the market is 50% of what it was during 2016-2019. While buyer demand has slowed, it has still not come down to a level that mirrors current supply. In fact, our market continues to see multiple offers on many properties.

So, if extremely low supply is holding sales prices up and also contributing to low total unit and sales volume, what is going to cause the supply to increase? Typically, high sales prices urge sellers to take advantage of these prices, especially when there is so much talk of a possible recession. High prices should also encourage developers and home builders to build desperately needed inventory of housing. Yet, we find this isn’t happening for a few reasons.

The higher interest rates that affect buyer demand also cause developers to hesitate to invest in projects. Yet beyond this, one of the biggest problems is getting sellers to sell their existing homes. Even people who would like to upsize or downsize find themselves stuck due to the affordability factor. Over 80% of homeowners have locked in their interest rate in the 3% range, less than half the current rates. For example, if people want to move to a home at a similar mortgage amount as their 3% loan, it could actually cost them 40-50% more in monthly payments. Even sellers who are financially strong, who decide to make the move anyway or pay cash for their next place, may decide to rent out their former property with the idea of taking advantage of the high rent prices and keeping the loan rate they won’t see again for a long, long time. Again, hurting supply.

Monthly Mortgage Payment, Median Home Prices

So, what does the future hold? The supply and demand battle will, as it always has, determine what the real estate market will look like over the next six months and beyond. The lack of supply in the Northwoods is not going to be fixed over the next 9 – 12 months. Even with the Fed’s commitment to weaken demand further, it has a long way to go to meet current supply. This imbalance has prevented prices from going down and could struggle to even hold prices flat in the short term. We don’t see prices dropping in the next 6 months. Depending on how things progress with interest rates, inflation, the consumers’ money supply, and a possible recession, there are potential risks in the long term. Some would say the Fed won’t be able to stop inching up rates until their actions cause at least some pull back in prices.

With these risks in mind, we would not be surprised to see real estate prices drop some, especially if interest rates crest the 7% range for any long duration. A situation like this could cause a modest pull back in values of 5-12% over the next two years. Although, it is important to understand that purchase price does not equal cost. For example, if you purchased a $400,000 home today at a 6.5% interest rate, your payment would be $2,023 (assuming 20% down, 30 yr. amortization). If prices fall 8% next year but interest rates are a mere 1% higher, you will have a purchase price of $368,000 for the same home but a mortgage payment of $2,058. So, in this example, your purchase price would go lower, but your payment will actually be greater. Note: many buyers are purchasing homes based more on payment than price.

Although we are asked the question every week “where are real estate home prices headed”, the decision to buy a home or second home in the Northwoods has many more factors than price. You must consider your overall enjoyment of a Northwoods property, the unquantifiable family memories created, and the lifestyle of a tranquil “Up North” experience.

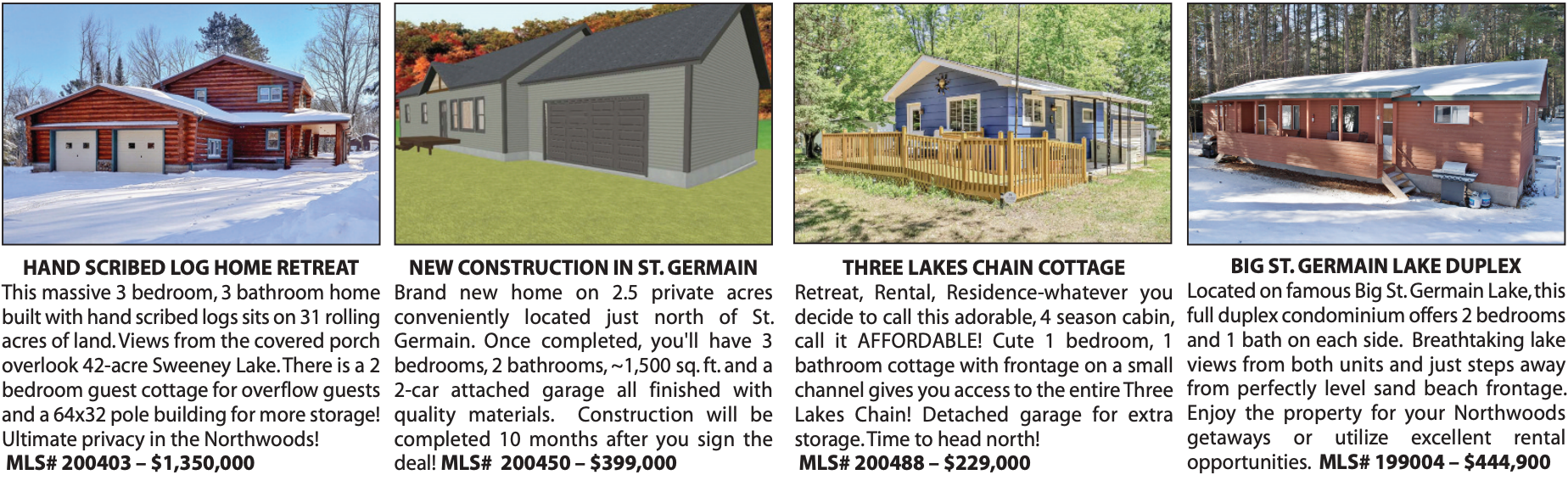

Clearly, there is much to consider. If you are looking for a home or simply want to keep up with the Northwoods real estate market, contact an Eliason Realty agent. We’d love to discuss Northwoods real estate with you, send you information about new listings as soon as they hit the market, and even help you keep track of home sales so you can monitor trends in the market.

If you are thinking of selling, or just want to find out what your Northwoods property is worth, contact us to provide a free, detailed, no-obligation market analysis of your home. We will let you know what it would sell for in today’s market so you can make an informed decision.